Redemptions

clear debt on risky vaults by exchanging USDA for collateral assets

Redemptions are a new Vault mechanic introduced with the deployment of Arkadiko V2.

A redemption is the act of using USDA to pay off the debt of an open Arkadiko Vault and receiving equivalent collateral asset tokens in return. This mechanism enables anyone to provide stability to USDA by buying it on the open market under 1 USD and subsequently exchanging it for 1 USD worth of collateral in an open Arkadiko Vault.

This provides an economic incentive to perform this type of arbitrage, making sure that USDA does not fall too far in value below 1 USD.

Redemptions are not a new idea and have been successfully used in Liquity as means to provide peg stability.

Inner workings

Arkadiko Vaults are ordered by collateralization ratio which is the ratio between the value of your assets in your Vault and your active debt.

Some Vaults are more healthy than others, meaning that they have more room for their collateral assets to decrease before being flagged for liquidation. In general, our protocol tries to avoid liquidations as much as possible, as they incur a hefty penalty of 10% to the Vault owner’s assets.

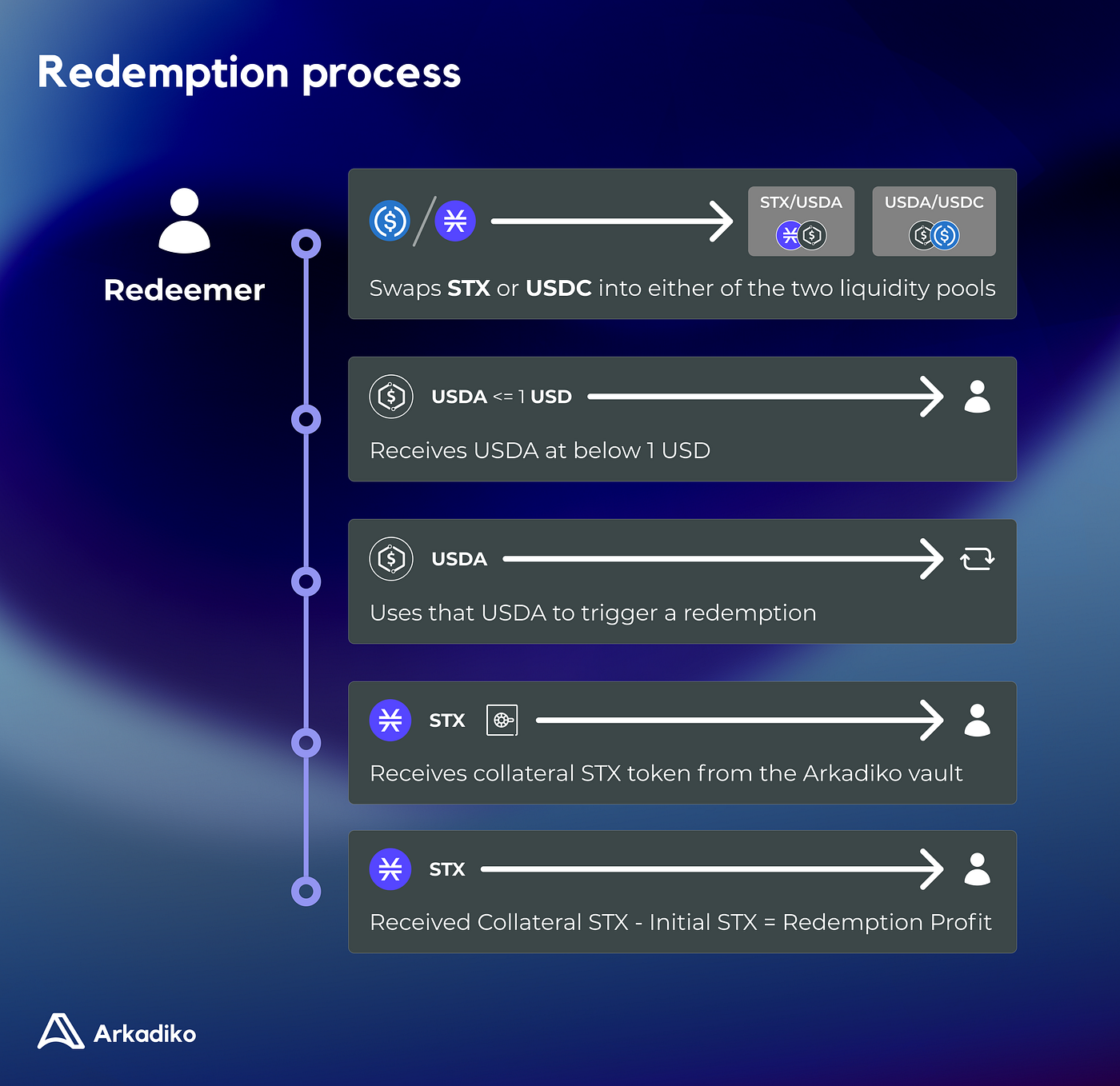

Redemptions are permissionless in the sense that anyone can trigger a redemption. The process goes as follows:

A redeemer queries the current least healthy Vault and receives back the amount of debt in that Vault.

The redeemer then uses USDA to pay off the debt in the Vault.

USDA is always valued at 1 USD by the protocol and based on the oracle price of the asset, the correct amount of collateral is taken from the Vault and sent to the redeemer.

That Vault has now become more healthy as it has its debt paid off in exchange for collateral assets.

Note that a Redemption can also be partial and does not have to pay off all the debt in the Vault.

Ofcourse, this process of Redemptions is only profitable for the redeemer if he is able to purchase USDA somewhere for less than 1 USD. For example, a redeemer would take 1000 USD worth of STX and uses it to buy USDA. He then triggers a Redemption and receives back more than 1000 USD worth of STX, generating a small profit. It is possible because somewhere, there exists a market, currently in the form of Liquidity Pools where USDA is purchasable for less than 1 USD.

Now in order not to enter a negative spiral of Redemptions, a dynamic Redemption fee is used. This fee starts at 0.5% and increases each time a Redemption takes place. If no Redemptions have taken place for some time, the fee decays slowly back to its initial base fee of 0.5%.

Usually, the knowledge that a Redemption mechanism exists is enough for users to confide in the system and not sell USDA at a serious loss, as they know it will be arbitraged to 1 USD again. So the presence of Redemptions means that they will be needed less often than if there was a non-protocol native way to arbitrage USDA. Redemptions are a soft-peg mechanism which should be needed less often than the hard-peg mechanisms such as buying and selling in liquidity pools.

Frequently Asked Questions (last updated: April 2024)

Is a redemption the same as paying back my debt?

No, redemptions are a completely separate mechanism. All one has to do to pay back their debt is adjust their vaults debt and collateral.

Is a redemption the same as a liquidation?

No, redemptions are a completely separate mechanism. A vault can be liquidated when it becomes unhealthy. In other words, when a vault's collateralisation ratio becomes lower than the liquidation ratio (and thus a liquidation of that vault will occur). A redemption can happen whenever a vault is the least healthy vault in the system for that specific collateral type, as sorted on-chain on contracts (see https://explorer.hiro.so/txid/SP2C2YFP12AJZB4MABJBAJ55XECVS7E4PMMZ89YZR.arkadiko-vaults-sorted-v1-1?chain=mainnet).

How can I avoid being redeemed against?

The best way to avoid being redeemed against is by maintaining a high collateral ratio relative to the rest of the vaults in the system. Remember: The riskiest vaults (i.e. lowest collateralized vaults) are first in line when a redemption takes place.

But what happens exactly?

This is what happens when your vault is redeemed against:

Debt Paid Off: A redeemer uses USDA to pay off a portion of your vault’s debt. This happens because your vault was selected as the least healthy vault (collateral-to-debt ratio-wise) for the specific collateral type.

Collateral Reduced: The redeemer receives an equivalent amount of your collateral (based on the USDA used) to cover the debt they paid off. This collateral is transferred out of your vault to the redeemer.

Remaining Collateral and Debt: After the redemption:

Your vault will have less debt (as the redeemer paid it off), and your collateral will also decrease by the amount given to the redeemer. The remaining collateral and debt will be reflected in your vault. Your vault will not be closed unless all debt is cleared during redemption.

In simpler terms, if your vault is redeemed:

Your USDA debt decreases

Your collateral reduces proportionally

And you retain the remaining collateral after the redeemer has been compensated.

For example: If you had 100 STX collateral and 50 USDA debt, and a redeemer uses 25 USDA to redeem, your vault will now show 75 STX collateral and 25 USDA debt. The redemption process ensures the stability of USDA and incentivizes maintaining healthy vaults. If you want to avoid redemption, you can add more collateral to improve your vault’s health ratio.

Last updated